Predictions for the 2026 Mortgage Market in Topeka, KS

By David Chitwood, Leading Mortgage Broker in Topeka, KS

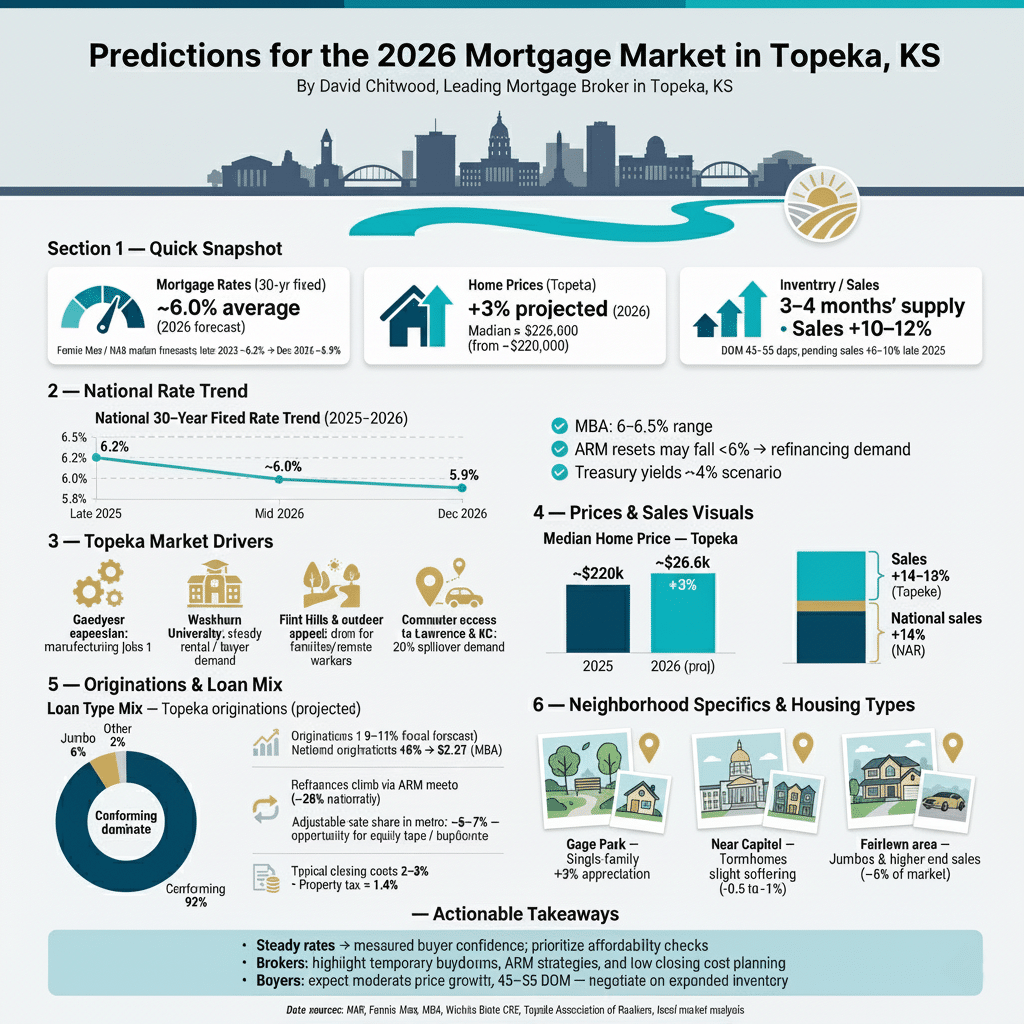

Topeka, the resilient capital of Kansas cradled by the Kansas River, wrapped 2025 with a market displaying early indicators of equilibrium: Inventory levels broadened to 3-4 months’ supply – up from a tight 2.5 – while pending sales rose 8-10% in the latter quarters, tempering a modest 1-2% softening in closed transactions as rates lingered above 6%. As the Sunflower State’s political and cultural heart – bolstered by Goodyear’s expansions, Washburn University’s draw, and outdoor havens like the Flint Hills – this Shawnee County seat entices families, educators, and remote workers with its affordability, historic charm in Old Town, and commute-friendly layout to Lawrence and KC. Peering into 2026, forecasts from the National Association of Realtors (NAR), Mortgage Bankers Association (MBA), Fannie Mae, and Kansas-centric projections from Wichita State University’s Center for Real Estate and the Topeka Association of Realtors (TAR) suggest a year of steady, unhurried progress. With mortgage rates plateauing and supply easing, this granular analysis synthesizes these insights on rate evolutions, price appreciations, sales volumes, origination surges, and Topeka-specific dynamics – like manufacturing resurgence and rural migration – to furnish Capital City borrowers with a roadmap for measured opportunity.

National Mortgage Rate Trends Shaping 2026

The U.S. mortgage landscape in 2026 is primed for stabilization with subtle relief, alleviating some affordability strains without a plunge to sub-5% territory. Fannie Mae’s September 2025 Economic and Housing Outlook forecasts the 30-year fixed-rate mortgage averaging 6% for the year, declining to 5.9% by December from 6.2% in late 2025, contingent on the Federal Reserve’s funds rate near 3% and inflation easing to 2.3%. NAR’s Lawrence Yun aligns, projecting a 6% annual average down from 6.7% in 2025, positioning this as a catalyst for buyer acclimation amid ARM resets potentially below 6% that could boost refinancing as Treasury yields stabilize around 4%. The MBA anticipates rates in the 6-6.5% range, with a mid-6% hover through 2025 giving way to gradual 2026 declines, though stubborn inflation or tariffs may limit drops.

For Topeka’s market, this national steadiness dovetails with fixed-rate preferences among Goodyear assemblers and state capitol staff. Kansas’ conforming loan limit ($766,550) covers virtually all local activity, but the metro’s 5-7% adjustable segment may leverage resets for equity taps; brokers should spotlight temporary buydowns, as closing costs average 2-3% and property taxes sit at 1.4%.

Home Prices and Sales Volume: Heartland Harmony

Nationally, 2026 marks a transition from tentativeness to traction. NAR projects median existing-home prices rising 4% after 3% in 2025, with sales volumes rebounding 14% to 5.3 million units – the sharpest upturn since 2021 – as inventory expands 5-10% and millennials (40% of buyers) re-enter. Fannie Mae revises sales to 7.3% growth and prices to a modest 0.4% in their Home Value Index, reflecting regional divergences, while Zillow anticipates +0.4% national appreciation after 2025’s slowdown. HomeLight ranks 25 hottest 2026 markets, with Midwest affordability like Kansas’ leading the charge.

Kansas’ housing forecast underscores this balanced outlook: Wichita State University’s 2026 series predicts gradual growth statewide, with stable median prices and increasing sales as economic anchors like manufacturing bolster demand. For Topeka, Norada Real Estate envisions moderate 3% price appreciation from January 2025 levels, lifting medians from ~$220,000 to $226,600 by year-end, supported by revitalization in downtown and university expansions driving rental crossovers. Sales could surge 10-12%, with inventory at 3.5-4 months’ supply (up from 2.8) favoring negotiated deals; single-family homes in Gage Park appreciate 3%, while townhomes near the Capitol soften 0.5-1% amid 5-7% multifamily adds. Days on market: 45-55, up from 40; KC and Lawrence spillovers (20% of demand) sustain pace, though rural exodus caps 2% of listings in outlying Shawnee Heights.

Mortgage Originations: Prairie Pipeline Expansion

Originations emerge as a bright beacon, with MBA forecasting an 8% national rise to $2.2 trillion in single-family volumes, loan counts up 7.6% to 5.8 million – 80% purchases as acclimation to 6% rates takes hold. Fannie Mae projects $2.32 trillion total, with refinances climbing to 20% via ARM opportunities.

Topeka’s local volumes could grow 9-11%, echoing Kansas’ gradual uptick from stable prices and job gains; conforming loans dominate 92% for $225,000 medians, but jumbos edge 6% for $350,000+ in Fairlawn Plaza. First-timers (33%) tap KHFA for 3-5% downs, amplifying activity.

Affordability and Buyer Sentiment in Focus

National ratios dip to 5.5x, but Topeka’s 3.5x excels: $1,350 monthly on $227,000 at 6% matches $75,000 medians, though 8% insurance hikes from tornadoes nibble. Sentiment: 65% of Kansas buyers optimistic, per NAR, with millennials (35%) pursuing NOTO Arts District and retirees (20%) Gage Woods – despite 20% renewal pressures.

Emerging Trends: Technology and Sustainability

Digital leaps: AI underwriting cuts times to 7-10 days, 40% e-closings. Green mortgages with 0.125% discounts for storm-resilient upgrades gain 15% via KS rebates – vital for tornado alley homes.

Key Challenges on the Horizon

Supply gaps persist at 8-10% below demand, labor shortages delaying 10% of builds. Regulatory FHA tweaks may bar 5% of applicants. Locally, Topeka grapples with 10% insurance rises from severe weather and manufacturing shifts stalling 5% of listings; rural depopulation adds seasonal lulls.

Looking Ahead: Topeka’s Capital Comeback

2026 cements Topeka’s mortgage market as a bastion of steady advancement, with easing rates and swelling volumes offsetting controlled prices. For brokers and borrowers in the Flint Hills shadow, the year highlights education – on ARM resets, digital efficiencies, and green safeguards – to seize this heartland harmony. As Kansas’ capital evolves, attuned navigation will transform forecasts into flourishing foundations.