Predictions for the 2026 Mortgage Market in Wichita, KS

By Randy Pitts, Leading Mortgage Broker in Wichita, KS

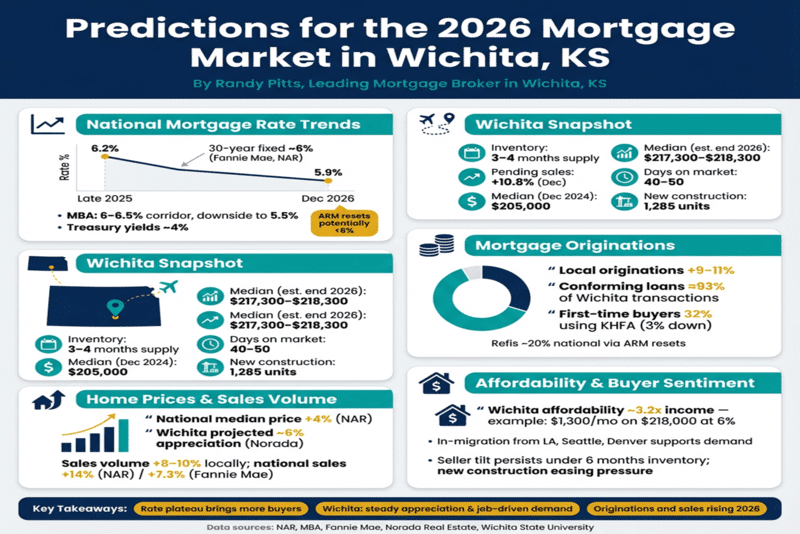

Wichita, Kansas’ Air Capital of the World, concluded 2025 with a market reflecting resilient steadiness: Inventory edged toward 3-4 months’ supply – up from a seller-favored 2.5 – while pending sales climbed 10.8% in December alone, balancing a modest slowdown in closings as rates hovered above 6%. Anchored by aviation giants like Spirit AeroSystems and Textron, a burgeoning healthcare sector at KU Wichita, and cultural draws from the Keeper of the Plains to Old Town’s revitalized lofts, this Sedgwick County powerhouse attracts engineers, families, and retirees with its affordability, low cost of living, and prairie expanses blending urban pulse with rural charm. As 2026 dawns, insights from the National Association of Realtors (NAR), Mortgage Bankers Association (MBA), Fannie Mae, and Wichita-specific forecasts from Norada Real Estate and Wichita State University signal a year of gradual normalization. With mortgage rates tempering and supply expanding modestly, this analysis aggregates these projections on rate paths, price dynamics, sales volumes, origination activity, and Wichita-tailored factors – like aviation job growth and migration from coastal metros – to equip Plains buyers and refinancers for a landscape of sustainable opportunity.

National Mortgage Rate Trends Shaping 2026

The U.S. mortgage environment in 2026 is poised for cautious easing, offering a lifeline to affordability without a swift return to ultra-low figures. Fannie Mae anticipates the 30-year fixed-rate mortgage averaging 6% for the year, slipping to 5.9% by December from 6.2% in late 2025, as the Federal Reserve’s funds rate stabilizes near 3% and inflation cools to 2.3%. NAR’s Chief Economist Lawrence Yun projects a matching 6% annual average, down from 6.7% in 2025, underscoring that this plateau – coupled with ARM resets potentially below 6% – will encourage buyer acclimation and refinancing as Treasury yields hold around 4%. The MBA forecasts rates in the 6-6.5% corridor, with downside potential to 5.5% on additional cuts but upside risks from tariffs or energy volatility nudging 0.25% higher.

In Wichita, where fixed-rate reliability suits aviation assemblers and educators at Wichita State, this national softening aligns with local dynamics. Kansas’ conforming loan limit ($766,550) covers 98% of transactions, but the metro’s 6-8% adjustable niche – popular for equity-rich refinances – may see hybrid interest; brokers should highlight buydowns, given closing costs at 2-3% and property taxes averaging 1.5%.

Home Prices and Sales Volume: Plains Normalization

Nationally, 2026 transitions from hesitation to harmony. NAR envisions median existing-home prices appreciating 4% after 3% in 2025, with sales volumes surging 14% to 5.3 million units – the first robust rebound since 2021 – as inventory grows 5-10% and millennials acclimate to 6% rates. Fannie Mae tempers sales to 7.3% growth and prices to 0.4%, but Zillow’s outlook signals +0.4% national appreciation, highlighting Midwest value plays like Kansas. HomeLight ranks 25 hottest 2026 markets, with Wichita’s affordability and job stability earning nods.

Wichita’s forecast embodies this “old normal” return: Norada Real Estate projects a 6% rise in home values for 2025-2026, building on December 2024’s $205,000 median (+3.4% YoY) and $117 per square foot (+4%), with stabilization by mid-2026 amid steady demand and low supply. Sales are expected to rebound mildly to 9,550 units in 2025 from 9,360 in 2024, potentially extending 8-10% into 2026, with inventory under six months maintaining a seller’s tilt but new construction at 1,285 units (up modestly) easing pressure. Medians could reach $217,300-$218,300 by year-end, with single-family homes in East Wichita appreciating 4-5%, while condos in College Hill lag 1-2% amid multifamily growth. Days on market: 40-50, up from 35; in-migration from LA, Seattle, and Denver (net positive) sustains velocity, though outflows to KC and Chicago cap rural segments at 2%.

Mortgage Originations: Heartland Volume Lift

Originations promise a solid upswing, with MBA forecasting an 8% national increase to $2.2 trillion in single-family volumes, loan counts up 7.6% to 5.8 million – 80% purchases. Fannie Mae projects $2.32 trillion total, with refis at 20% via ARM resets.

Wichita’s pipeline could expand 9-11%, mirroring Kansas’ gradual growth from aviation (10,000 jobs) and migration; conforming loans rule 93% for $218,000 medians, but jumbos rise 7% for $350,000+ in Delano. First-timers (32%) use KHFA for 3% downs.

Affordability and Buyer Sentiment in Focus

National ratios ease to 5.5x, but Wichita’s 3.2x excels: $1,300 monthly on $218,000 at 6% fits $75,000 medians, though 8% insurance hikes from tornadoes pinch. Optimism: 65% of Kansas buyers active, per NAR, with millennials (35%) eyeing College Hill and retirees (20%) Oaklawn – despite 20% renewal shocks.

Emerging Trends: Technology and Sustainability

AI approvals in 7 days, 40% digital. Green mortgages with 0.125% discounts for wind-resistant upgrades gain 15% via KS rebates – key for Plains prairies.

Key Challenges on the Horizon

Supply trails 8-10% demand; labor gaps delay 10% builds. Locally, storms inflate insurance 10%; aviation cycles add volatility.

Looking Ahead: Wichita’s Air Capital Ascent

2026 elevates Wichita’s mortgage market to normalized heights, with rates and volumes harmonizing modest prices. Plains preparation unlocks aviation avenues.