Powered by

| NMLS ID 12007

Your Path to the Perfect Home Starts Here with a Trusted Mortgage Lender

LeaderOne Financial — Mortgage Lender Topeka

Want to make your dream home a reality? Mortgage Squad is here to help. As a trusted mortgage broker and mortgage lender serving Wichita and Topeka, Kansas, Randy Pitts and David Chittwood bring extensive expertise to make buying, refinancing, or investing in a home easy and straightforward. Randy, based in Wichita, Kansas, and David, based in Topeka, Kansas, work together to find the perfect loan solutions for clients in Kansas and beyond.

Excellent 4.9 out of 5

Find the Best Mortgage Options in Wichita, Kansas & Topeka, Kansas

Home Loans

Made Easy With Mortgage Squad

Finding the perfect home is important, and choosing the right loan is essential. Mortgage Squad makes the process simple, providing expert mortgage brokerage services in Wichita, Kansas, with Randy Pitts based locally and David Chittwood in Topeka, Kansas. Whether you’re buying a new home, refinancing, or investing, our team brings local knowledge and a commitment to finding you the ideal loan.

Your Home, Your Loan.

Looking for a home loan? Mortgage Squad offers a wide range of mortgage options tailored to fit your needs and budget, including conventional, FHA, VA, and USDA loans. Our mortgage bankers, Randy Pitts in Wichita, Kansas, and David Chittwood, based in Topeka, Kansas, bring local expertise and personalized service to help you find the perfect loan solution.

Construction Loans

Looking to build your dream home? Mortgage Squad offers construction loans, a short-term financing option tailored specifically for new home construction.

Reverse Mortgages

A reverse mortgage is a unique loan product designed specifically for homeowners aged 62 and above. It allows you to access a portion of the equity you’ve built up in your home without having to sell or make monthly payments.

Down Payment Assistance

At Mortgage Squad, we’re here to help make homeownership accessible. Our mortgage bankers, provide valuable information and assistance on a variety of down payment assistance programs. These programs are designed to make buying a home achievable for a broader range of clients.

Non-QM Loans

Mortgage Squad is committed to making homeownership accessible, even for those with non-traditional income sources or credit challenges. Our experienced mortgage bankers specialize in offering tailored loan options to meet the unique needs of every borrower.

Loan Programs for Investors

For real estate investors, Mortgage Squad provides specialized financing solutions tailored to investment properties, including rental and resale ventures. With expert mortgage bankers we understand the unique needs of property investors.

Home Purchase Loans

At Mortgage Squad, we offer a variety of loan options to help make homeownership accessible to everyone. Our offerings include conventional, FHA, VA, and USDA loans, each tailored to meet unique borrower needs and financial situations.

Refinancing Solutions

Mortgage Squad offers refinancing options to help homeowners optimize their current mortgages. Whether you’re looking to adjust your interest rate, change loan terms, or tap into your home’s equity with cash-out refinancing, our team is here to guide you. We provide expert support to help you find the best refinancing solution for your financial goals.

First-Time Homebuyer Programs

At Mortgage Squad, we’re dedicated to making the home-buying journey easier for first-time buyers. Our experienced mortgage bankers are here to ensure that your path to homeownership is accessible, manageable, and stress-free.

First Time Home Buyers

Loan Types and Options

Mortgage Glossary

APR (Annual Percentage Rate) represents the total cost of borrowing, including the interest rate and other loan fees, expressed as a yearly rate. It helps you compare the total cost of different loans.

Refinancing is replacing your existing mortgage with a new one, often to lower the interest rate, reduce monthly payments, or tap into home equity. It’s beneficial when interest rates drop or your financial situation improves.

LTV ratio measures the relationship between the loan amount and the value of the property. It’s calculated by dividing the loan amount by the home’s value. Lower LTV ratios can lead to better loan terms.

Pre-qualification is an initial assessment of your lending power based on self-reported financial information. Pre-approval is a more rigorous process that involves a credit check and verification of your finances.

PMI is insurance that protects the lender if you default on your loan. It’s typically required on conventional loans when your down payment is less than 20% of the home’s value.

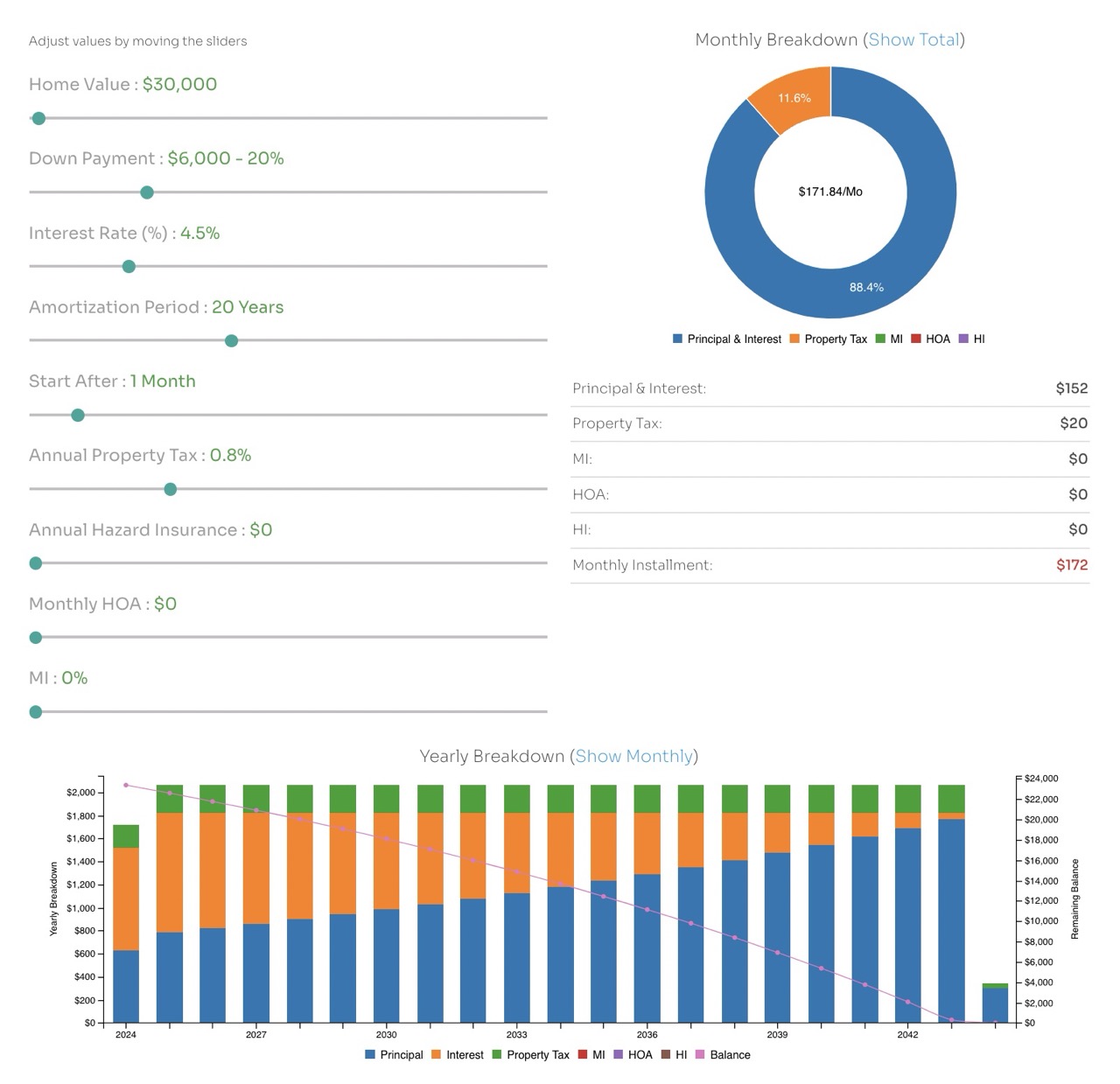

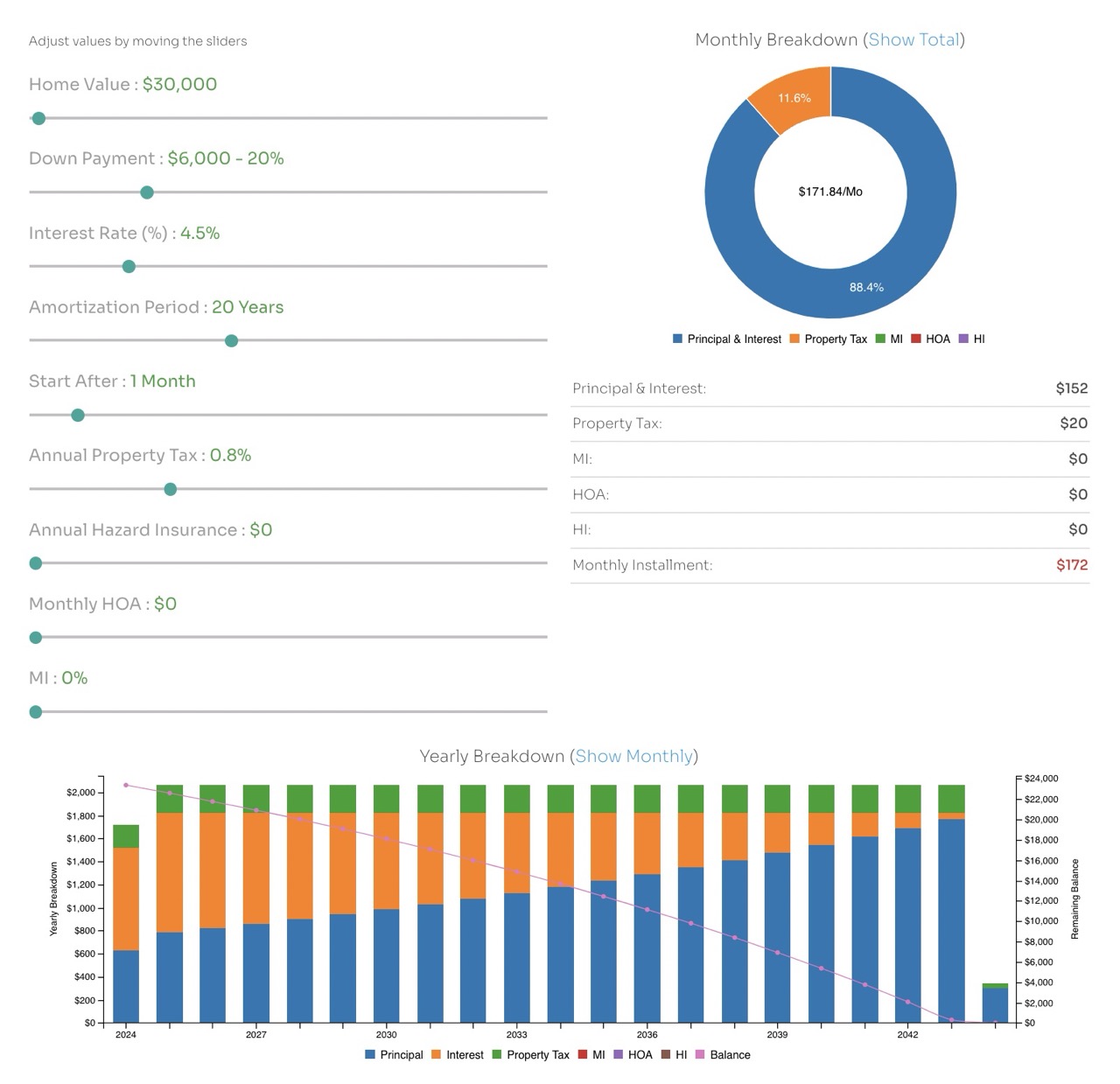

Mortgage Squad Calculator

Customization

Amortization Details

Monthly Breakdown

Yearly Overview

Get in touch!

Your Dream of Home Ownership is within Reach.

Contact

Mortgage Squad

149 S Andover Rd, Andover, KS 67002, United States

Topeka: (785) 450-9056

Wichita: (316) 448-6947

NMLS ID #12007